15 Minutes of Fame

So as promised in last week’s post, here’s a whole load of data that breaks down CubeCheater’s 15 minutes of fame over the last couple of weeks.

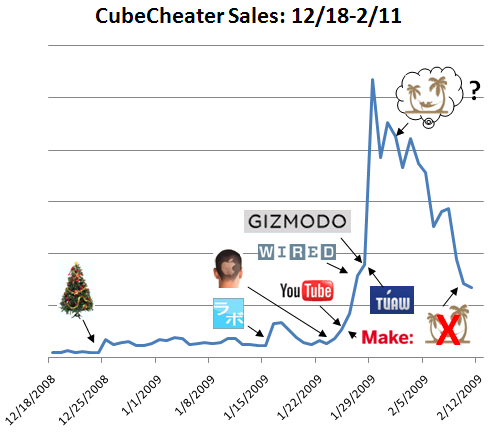

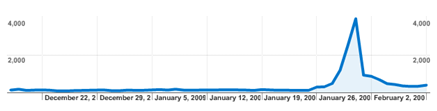

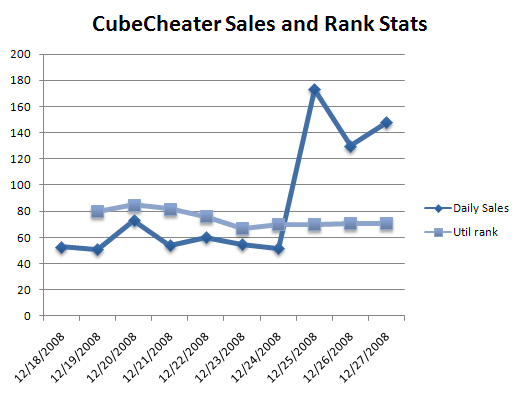

First, the obligatory chart of App Store sales:

As you’d expect, sales saw a big boost after getting publicity, and then dropped back off afterwards.

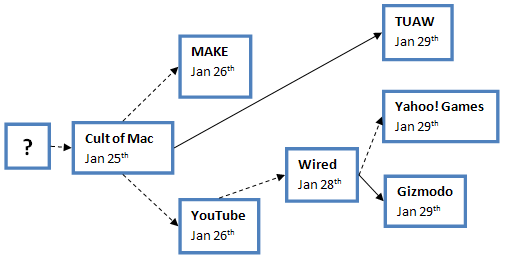

Many sites include “via” links as a way to give credit to the people they got some content from. It’s interesting to plot these links in and see how content spreads through the blogosphere. Here’s a link graph, with solid lines indicating confirmed “via” links, and dashed lines representing my best guesses as to how the content spread:

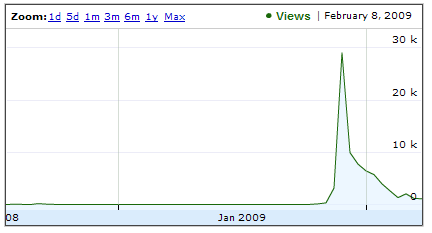

The next interesting bit of data is to look at YouTube’s new “Video Insight” feature, which tracks a lot of data about how your videos are viewed. The view count graph is about what you’d expect: a huge spike and then near-total falloff:

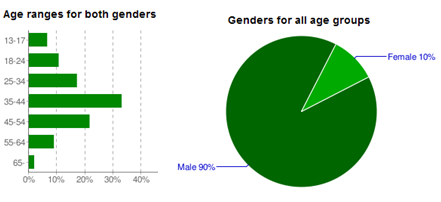

The YouTube viewer demographics are more interesting:

I was surprised at the age range: well more than half of the YouTube viewers were over 35 (I would have expected the majority to be under 30). The gender breakdown is 90% male, 10% female - I am actually a little surprised it was skewed this much. Both of these statistics probably have more to say about Wired & Gizmodo readers than they do about YouTube viewers or iPhone owners (since the vast majority of YouTube views came from embeds on those two sites).

The last bit of interesting data I have is from the hits directly on my CubeCheater web site. Here’s the graph of daily pageviews, which shows a spike similar to the others, though its shape is slightly different:

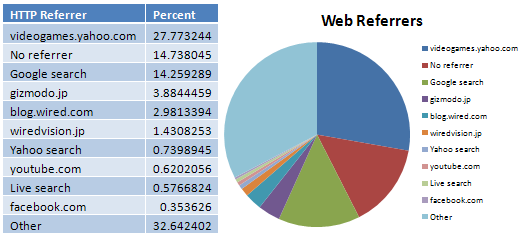

The HTTP referrers also reveal some interesting tidbits:

Surprisingly, Yahoo is by far the #1 referrer, most likely due to the fact that the Yahoo Games article did not include an embedded YouTube video: it was the only one which prominently linked to the CubeCheater website directly.

The vast majority of search keywords during this period were either cubecheater or cube cheater. For these terms at least, Google Search apparently has about 20 times the traffic of either Yahoo Search or Live Search.

As Seen On..

This week CubeCheater has gotten a storm of publicity, ever since one of the videos was featured on YouTube. I'm getting so many comments and emails that it's been hard to keep up with it all.

So far the two YouTube videos have been viewed a combined 90,000 times. A Google search for "+cubecheater" now returns 2.3 million results, where it returned zero little more than a month ago (the vast majority of those are spam sites & splogs, of course).

Once everything settles down I'll write up a full post with all the relevant traffic charts and link graphs (yay, data!). In the meantime here's a preview of the good bits:

CubeCheater - As Seen On:

- Gizmodo: "iPhone Rubik's Cube Solver Is Pure Genius"

- Wired: "iPhone App Solves Rubik's Cube in 20 Moves or Better"

- TUAW: "CubeCheater solves that Rubik's Cube for you"

- MAKE: "iPhone app will help you deconstruct the Rubix cube"

- Cult of Mac: "Your iPhone is Better than You at Solving a Rubik’s Cube"

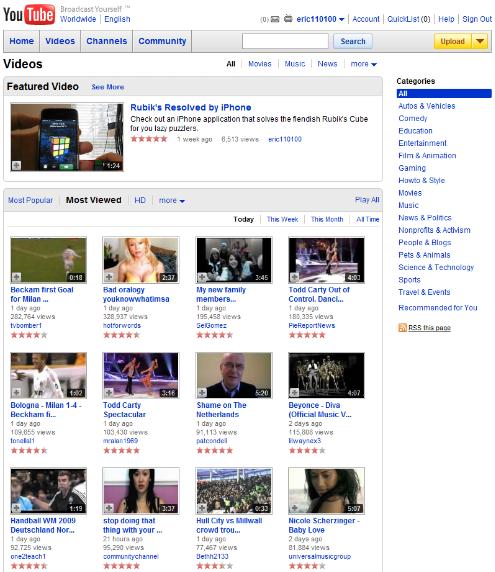

Featured Video

For a brief moment today, this was the Videos page on YouTube:

A CubeCheater video is at the top in the "Featured Video" section!

So far it looks like being featured was worth about 10,000 views. Alas, since the video doesn't feature any scantily clad women and/or European soccer games, it probably won't get 100,000 views and show up in the coveted "Most Viewed" section.

Tomorrow I'll check the sales reports to see how YouTube views affect actual App Store sales. Based on previous experiences, my prediction is that about 3% of the YouTube views will translate into purchases, which is actually pretty good given that it's basically free advertising.

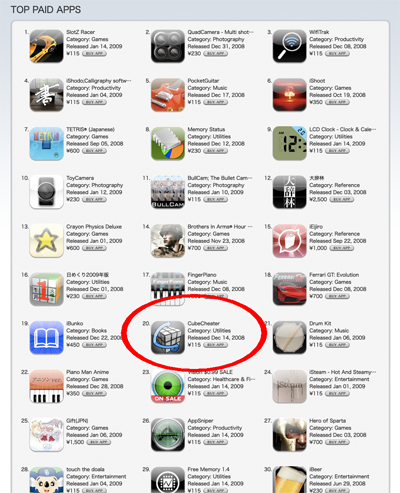

Big in Japan

This week CubeCheater officially became big in Japan. Kan Omi of ipodtouchlab.com wrote up a very generous review on his popular iPhone/iPod Touch site. It's quite extensive and even includes his own YouTube video:

His YouTube video has already been viewed 3,000 times, which is about 3 times more than mine has been viewed in a month.

On the first day the sales in Japan shot up from about 0 per day to 218, netting a cool 25,000 yen. CubeCheater is now #20 on the Top Paid Apps list in the Japanese App Store - and that's all apps, not just Utilities:

For comparison, in the U.S. App Store, it peaked at around #30 in Utilities, and never came close to making the Top list of all apps, which is dominated by games and fart apps.

Dryer Vent

The dryer vent on the roof of the apartment across the way from mine has been spewing out this weird looking red stuff all morning:

I wonder what they put through the wash?

First Week of App Store Sales Stats

CubeCheater has been on sale for one week now, so I figured I would post the sales stats since they are pretty different from what I was expecting them to be like. It’s always a question about whether or not you should post your sales stats, but I think that one week of data doesn’t reveal too much. It was really useful for me when other iPhone app developers posted their stats, so maybe this info will help others who are thinking about jumping in too.

While I was making the app I was expecting to get only one or two sales until the app was reviewed by a prominent iPhone site or blog, at which point there would be a spike of sales, followed by a drop-off back down to almost zero sales after a few days. So my strategy was to make a gimmicky sort of app that bloggers might find interesting, and then try to get someone to write about it. It’s now looking like that might be the wrong strategy to use in the App Store.

The first surprise was that the app has sold more than 50 copies each day that it’s been available, and as far as I can tell there has been absolutely no English press about the app at all yet which would be driving these sales. At first I thought that it might have been due to the app showing up in the “new apps” section in iTunes on the day it was released, but it hasn’t been new for a week now, and the sales are still keeping up. Without any press or publicity, my only guess is that people are finding the app by browsing the Utilities section in iTunes, where it currently is ranked around #70.

The next semi-surprise was that I started to receive a whole bunch of emails from customers who had purchased the app. Many of them were of the “Hey, great app!” variety, but a lot of them were from people who liked the app but couldn’t use it because it didn’t work with the cube that they had. Among other problems, it turns out that all cubes sold in Japan and many in Europe use a different color scheme than cubes currently sold in the U.S. The app would tell the user to input the “Blue face with the White face on top”, which would be impossible because the Blue and White faces are on opposite sides of those cubes. I rushed out a 1.1 update to support that style of cube (and custom user-specified styles), but the update has been languishing “In Review” for almost a week now - Apple’s system was closed for much of the Christmas week, so I’m hoping that the update will go live sometime this week.

So far only 68% of the sales have come from the U.S., meaning that a full 32% are coming from overseas, which is more than I had originally expected. The app isn’t localized at all - it’s only available in English. Localizing it would require paying quite a few translators to translate all the text strings in the app, which could get expensive depending on how many languages I wanted to support. At this point I’m not really sure how to tell whether or not it would be worth doing that, financially-speaking. I designed the app’s UI under the assumption that nobody reads any explanatory text anyway, so it’s pretty graphical and should be usable without knowing much English. It seems to be selling OK in non-English countries, and I haven’t received any emails requesting that the app be translated into a specific language, so maybe it is OK as it is. On the other hand, that’s sort of an argument from fallacy because if people aren’t buying the app since it’s not available in their language, then they wouldn’t be sending me emails in the first place. Also, a large majority of sales have been from the U.S., U.K., Canada, and Germany, where most everyone understands English (or at least the people who are buying iPhone apps). At this point I think that if I did localize the app, the first languages to tackle would be Spanish, Portuguese, Japanese and Chinese, in order to cover the largest number of potential customers.

Anyway, enough with all the blathering, let’s get to the meat of the post: the actual sales stats. Here’s a graph of CubeCheater’s daily sales, overlaid with its rank in the Utilities category in iTunes:

This graph shows a few interesting things:

- The sales were pretty consistent leading up to Christmas, at which point there was a huge jump. Right now there are only two data points after Christmas, so it’s hard to say if this is a permanent shift or if it’s a one-time fluke. I assume that it happened because a whole bunch of people got new iPhones and iPod Touches for Christmas, so I wouldn’t be surprised if the new stable sales point is somewhere in between.

- The iTunes rank stayed constant even through the Christmas spike. The rank is determined by number of downloads, so the fact that it remained the same indicates that all iPhone apps probably experienced a similar huge jump in sales (See: A Christmas iFart Explosion: 40,000 downloads - Man do I wish I had thought of that app).

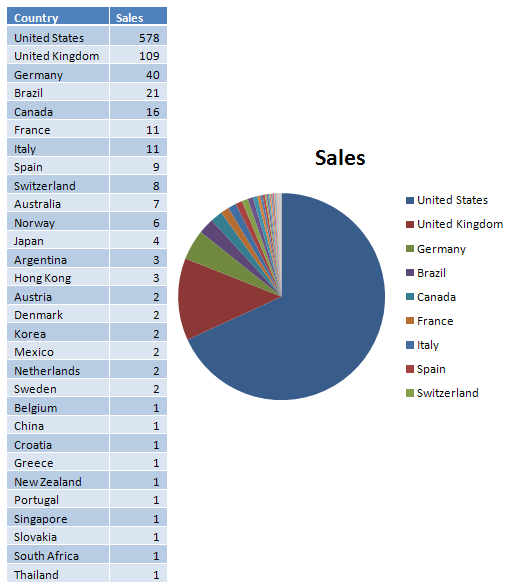

And here are the sales broken out by country for the 12/18-12/27 period:

It’s interesting to see that there’s sort of a “long tail” of countries where the app was purchased one or two times, but not in the Chris Anderson/power-law sense, since the bottom 80% of the countries only account for 10% of the sales. With this distribution I could completely ignore all but the top 3 countries if by doing so I could increase sales in those countries by 20%.

Other random thoughts after one week of sales:

- The YouTube demo video has been viewed only 573 times. Given that many of the YouTube viewers probably did not end up buying the app, this means that far less than half of the people who did buy the app watched the demo video or visited the web site for the app before buying it. I had originally thought that most people would buy the app after watching the video, but it looks like this is not the case.

- It’ll be interesting to see how long these sales numbers remain consistent. On one hand, you’d expect the sales to drop off after all of the people with both cubes and iPhones buy the app. On the other hand, the installed base of iPhones is still increasing exponentially now, which might counteract that drop-off.

- I’m curious to see how the sales are impacted if the app does get any mentions on any high-profile sites. Other developers have noted large yet temporary sales spikes.

CubeCheater Available for Sale

This morning I received a mail from Apple saying that CubeCheater was approved and is now available for sale!

It took about three days for the app to be approved, which is not too bad - I was prepared for it to take up to a week or more. Still, according to iTunes there were a whole bunch of apps which were apparently submitted yesterday and today which were also approved at the same time, so something about the process still seems a little fishy. I'm not complaining though!

Another strange thing is that now I am only given 700 characters to type a description of the app, which is not really even enough room to fully describe all of the features. I think the limit used to be 4000 characters, and other app developers certainly took advantage of that space to write long-winded advertisements for all of their other products. Maybe this is a new shorter limit in order to cut down on that sort of behavior. It certainly forces you to be terse and succinct.

Interestingly enough, a Brazilian iPhone blog has already written up a post about the app (in Portuguese): http://appstoreblog.com.br/2008/12/resolva-o-cubo-de-rubik-em-poucos-segundos-usando-o-iphone/

Here's the iTunes link to the app: http://itunes.apple.com/WebObjects/MZStore.woa/wa/viewSoftware?id=300162540

And a screenshot of the app for sale:

CubeCheater

Loyal readers have probably noticed that I haven't been posting very often in the last couple of months. During the spare seconds between my job and two classes at UW, I've been working on a new iPhone app.

I'm pleased to (finally) announce that the application is complete and should be available on the iTunes App Store soon. I just uploaded it and am now waiting for Apple's approval before it goes live.

The app is called CubeCheater and is an iPhone/iPod Touch app for solving everybody's favorite 80's puzzle cube. You input the state of your cube, and it will compute an optimal (or near-optimal) solution to solve it.

It uses the Group Theory algorithm discovered by Herbert Kociemba to do the solving. I haven't tried all 519 quintillion cube configurations, but I have run through quite a few random ones during my testing and I've never seen the program give a solution worse than 22 moves (the current upper bound [2] on optimal cube solutions as of August 2008). On average it takes about 7 seconds to find a good solution.

The other particularly cool part of the app is that it takes advantage of the iPhone's camera and can recognize your cube from pictures you take of it, using computer vision. I was pleased with how well this turned out - if you orient the cube properly with good lighting, it recognizes the cube perfectly every time.

That feature and most of the cool animations and 3D effects are best experienced by watching the app in action, so if you're interested, head on over to the website and check out the embedded YouTube video (or view it directly on YouTube, and don't forget to click "watch in high quality").

Here are some screenshots:

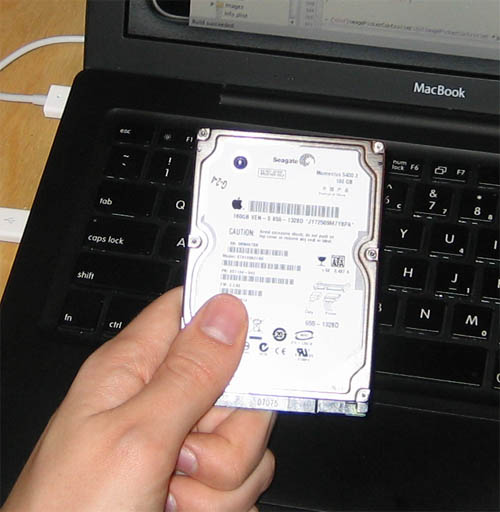

Another Dead Laptop HD

On Thanksgiving day my laptop decided to boot up with the "flashing question mark folder" error of doom. No amount of recovery tricks helped - it looks like the disk just mechanically failed.

The laptop hadn't been bumped around too much, but it did get its fair share of everyday jostling. Still, failing after one year still seems pretty bad (of course it was just over one year, and the warranty was for 1 year). It reminded me of the recent CMU study which showed that real disk failure rates are 15 times what vendors claim..

Fortunately I had properly backed up all of my data and didn't lose anything important, other than 3 hours of work since my last CVS commit. Unfortunately I hadn't actually backed up the entire system, so after I replaced the disk with a spare I had to reinstall all the software and re-tweak all of the settings, which took several hours. Lesson learned: I have now applied the hack to enable Time Machine backup to network shares and am fully backed up. Unfortunately, Time Machine is basically incompatible with FileVault (unless you log out and back in every day), which sort of makes it impossible to either back up or encrypt your important stuff (and on laptops especially, you want both to work).

Anyway, my next laptop will definitely have one of the new Intel SSDs, which should theoretically be much more resilient to mechanical failure since they have no moving parts. They haven't been on the market long enough to get any good reliability data, but it would be hard to do worse than the Seagate drives I've had recently.

Bad Sign

Hmm, is it a bad sign if you're at a restaurant and the pen they give you to sign the check is from a local pest control company?

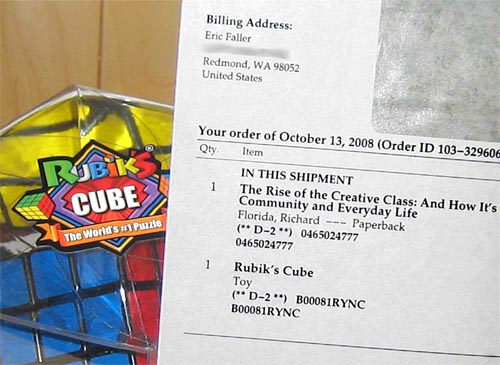

0 Day Delivery

The most amazing thing happened today: I ordered some stuff on Amazon this morning, and it was delivered before I got home. I was completely stunned and surprised, because I submitted my order with the standard 2 day shipping and didn't see anything about same-day delivery. I was also surprised that the package was just outside my door and they didn't deliver it to the apartment office in order to get a signature.

The package was shipped by some company I've never heard of, called Dynamex. I can't find anything about this on Amazon's website. I'm curious about whether this is a new standard, or if it is some sort of beta program being tested in select areas? What's going on here?

This is a big step that could really impact how I use Amazon. Typically, it feels like I get the desire to have a new book or toy on Saturday or Sunday afternoon, at which point I have to decide how much I really need whatever it is. If it's urgent, then I usually have to go to Borders, because if I order it on Amazon, it won't be shipped until Monday, and if I'm lucky it will be delivered on Wednesday, but it'll get delivered to the apartment office which will be closed when I get home, so I'll only be able to pick it up on Thursday morning on the way to work. With this same-day delivery, that huge wait time is almost eliminated (of course they probably wouldn't deliver on weekends, but still).

Here's a picture of my October 13th order, actually in my hands on October 13th. The weird thing is that I had already looked through all the toy stores in suburban Seattle trying to find a Rubik's cube (apparently there's a "Rubik's Liquidity Crisis" going on, because they were all out). I had resigned myself to ordering it on Amazon and waiting a week, yet here it is and I have it on the same day. Wow.

Trip Report

I got back from my trip last Sunday night, but was too busy catching up on various things to write up a post about it until now.

Overall the trip was totally awesome! Except for a tropical storm at the beginning, the September weather was perfect for almost the entire time. I was able to see everything on my (long) list and even more. In fact, two weeks might even have been a bit too long: on the second-to-last day I realized that I had pretty much seen all the big-ticket sights, as all I had left to see that day were the semi-abandoned grounds of the 1964 World's Fair and under-demolition Shea Stadium (both somewhat underwhelming).

I had originally only planned to scope out a few of the top software companies, like Google and Fog Creek, but some unexpected turns of events left me with a lot of free time to explore others as well. I was somewhat surprised at the sheer number of cool software jobs and startup companies which were located in NYC. Google's offices in Chelsea were particularly awesome (er well, the building and location are awesome, but the 'offices' are actually more like cubicles and 'open workspaces' - I'm not sure what I think about those yet..). Of course, while I was there, the entire financial industry sort of imploded on itself, which will undoubtedly lead to a glut of thousands of out-of-work bank IT workers, pushing down programmer salaries there for some time. Million-dollar Wall Street bonuses probably won't be making appearances again for a while either..

I was able to get out of the city for a day and got a tour of Princeton, NJ from my friend Savraj who lives there working on his Y Combinator startup. The startup life sounded pretty cool. I was also considering going to Boston for a day (lots of interesting companies & opportunities there as well), but decided not to when I found out that it would have and cost 4 hours and $100 each way on Amtrak.

Due to the outrageous ticket prices, I only saw one Broadway show while I was there: The Lion King. I wasn't quite sure what to expect going in. Now that I've seen it, I suppose that if your goal was to make a Broadway musical out of that Disney movie, they did a good job. It was well staged, choreographed, and acted. But it also re-used most of the dialog from the movie, as well as the fart jokes (which, in the commentary, the directors of the movie admit were inserted in order to keep 6 year-olds from becoming bored), leading to many awkward, incongruous moments. It felt like nobody had ever stopped to ask "Wait, why are we making a musical out of this??" (In reality I'm sure that question was asked at some point, and the answer was "Because it will make millions of dollars!").

I'm sure that everybody has seen the internet-famous map of the distribution of single people in the US. It pointedly shows that the Seattle area has 40,000 more single men than women, but the NYC area has about 200,000 more single women than men. The dearth of attractive, single women in Seattle has certainly been stunning, so I was curious about whether the opposite effect would be noticeable in New York. It was quite noticeable - surprisingly so, even. There seemed to be beautiful women everywhere - on the street, in shops, on the subway, etc.. I'm trying to do the math to figure out whether this could have just been an anomaly (due to NY Fashion Week coinciding with my trip, or something like that). I'll run the numbers from the National Geographic article to calculate the "expected odds" and post the results up soon. Either way it was quite impressive.

Another particularly striking thing for me was the efficiency of the public transportation system. I had no car but didn't feel like I needed one at any point, since I could easily get to basically anywhere in the city using the subway. It really puts to shame the public transportation systems in cities like Denver or Seattle, which basically consist of "some buses". Building a real subway system in these sort of cities today would require absolutely astronomical amounts of money, so it's probably hopeless at this point.

During the second week I didn't bring my camera around as much unfortunately, but some of the pics I did take are below (the first week's pics are in the previous posts).

I took a whole lot of pictures from the top of the Empire State Building, figuring that I could find some software to stitch them all together into a panorama automatically. Interestingly enough, while I was there Microsoft Research released a free tool which does exactly that. It works pretty well, though it did screw up a few places like the Brooklyn Bridge. Here's a thumbnail of the panorama, linked to a larger version:

The larger version is still only 15% of the full-resolution image which is 16,000 pixels wide at 150 MB, way too big to upload here :).

I tried to attend a taping of the Daily Show, but I didn't realize that all the reserved tickets are gone months in advance, and the standby line was ridiculously long, even several hours before the taping (apparently the guest that night was some guy named Tony Blair). When I realized that I wasn't going to get in, I ran over to the Colbert Report studios, but by that time it was too late there as well.

Arms and Armor at the Metropolitan Museum of Art.

A cheese steak sandwich, which was quite good, but presumably also quite unhealthy.

Lions and gazelles at the Bronx Zoo.

The Unisphere from the 1964 New York World's Fair.

On the flight back all of the in-seat video consoles simultaneously crashed and rebooted during some turbulence (always a good sign..). I was only able to get a cameraphone pic of Tux before it was back up again.

Week 1 Update

No time for a full recap yet, so here are some pretty pictures to look at:

Rockefeller Center, NBC Studios

Vincent Van Gogh - Olive Tree

John Lennon memorial - Imagine

UN General Assembly hall

Apple 5th Avenue store (craziest Apple store ever)

WTC Ground Zero (on September 12th)

Statue of Liberty

Cars on the Brooklyn Bridge at night

Astroland amusement park at Coney Island (one week after it went bankrupt and closed, naturally)

NYSE on Wall Street (on Monday it was a total zoo due to the Lehman Bros/AIG/Merrill Lynch disaster)

New York City

So after thinking about it for a long time, I finally got around to going to New York City!

I got here on Saturday, and so far it's been awesome! (other than getting rained on by Tropical Storm Hanna)

I'm here for two weeks, which should be plenty of time to see all of the big-ticket attractions and some of the smaller ones too.

I'll write up a more detailed trip report when I get back, but for now here are some pretty pictures:

View from the Empire State Building, with Central Park visible in the background.

The view from Central Park.

Thoughts on (not) owning company stock

At work recently some discussion came up about owning stock in the company we work for. I briefly mentioned the fact that I do not own a single (vested) share of stock in the company and was treated with scorn and disbelief. Am I some sort of traitor? Do I not believe in the company? I tried to explain that no, it had nothing to do with any of that, but didn't get a chance to fully explain my reasoning. So here goes.

While the decision is certainly made easier by the fact that the stock in question has grossly underperformed the market for more than five years, I base my reasoning mainly on sound investment policy. Even if I worked at Google or Apple I would do the same (in theory, anyway).

It's all based on one basic principle: not being a sucker. There are three reasons why you risk being a sucker if you have large holdings in the company you work for, all related to diversification:

- If you are an employee of a company, your salary is tied to the fortunes of that company. If you have lots of stock in the company, then so is a large part of your savings. This is a very strong correlation, and correlation among financial assets is very bad. If anything bad happens to the company, you could lose not only your job, but also your savings. There are many examples of this happening - we've all heard the stories of the thousands of Enron employees who lost their jobs along with their entire 401(k)'s (100% Enron stock). A similar thing happened recently to all the United Airlines "employee-owners" who foolishly voted to convert their pension fund into United stock: the company went bankrupt, the stock became worthless, and many of them were laid off.

- It is a bad idea to own large amounts of any one individual stock, regardless. Each additional share has a 100% correlation with all the others and creates un-hedgable risk that the entire position might blow up. Examples of people losing large amounts of money on single stocks are so common that they're not even worth repeating here.

- Along the same lines, you don't want to have significant holdings in any one individual market sector either, because all of those stocks correlate fairly well with each other, and that correlation creates risk. There were many people who worked in the tech industry during the late 90's and "diversified" their portfolios by owning a variety of telecom and dot-com stocks (since those were the "hot" sectors). When the bubble popped, they had significant losses (and were probably laid off as well). So you don't want to own lots of stock in the sector you work in, which by definition includes your company.

At this point the common responses are along the lines of "Bah, I don't expect that our company (or market sector) is about to go bankrupt!". As Nassim Nicholas Taleb might point out: that's exactly the point. Nobody expected Enron to suddenly blow up: the sheer unexpectedness of it is precisely what made it such a spectacular disaster. If the market expects a company to go bankrupt, the stock will already be trading around $0, so it will be too late (see: Freddie Mac, GM, etc.). The unexpected events (so-called "black swans") can be the most risky and need to hedged against along with the run-of-the-mill risks.

With all that in mind, there are some questions which inevitably pop up:

- Don't you lose out big-time by immediately exercising stock options? Shouldn't you hold them for a while until the stock has gone up considerably? Sure, but those are stock options and are a different beast with their own set of incentives. But given the recent industry trend toward eliminating stock options and replacing them with stock "awards" and "grants", there are fewer and fewer incentives that favor the employee holding onto the stock. Companies started switching away from options after the Enron scandal in order to avoid large "surprise" expenses on their accounting books, which means that typical employees will no longer be "surprised" to strike it rich one day. With stock grants, there's basically no particular incentive for employees to hold onto the shares (and many disincentives, as discussed above).

- What about the tax implications? Won't there be unfavorable capital gains taxes if you sell immediately? At first I thought this would be a problem as well, but after looking into it, it turns out that it isn't. In fact, it can actually simplify your capital gains taxes if you sell all of your shares as soon as they vest. Stock grants are treated as ordinary income on vest, and some of the shares are withheld for taxes at that point. So the remaining shares have already been taxed, and if you sell at that point then there's neither a capital gain nor a capital loss, and thus no further tax implications. With no capital gain, there's also no particular incentive to hold the shares for at least a year in order to get the long-term capital gain tax rate.

- What about employee stock purchase plans? These work slightly differently, but end up being similar. Typical plans allow employees to purchase the company's stock at a given discount, like 10%. As long as the purchase date is the same as the vest date (with no backdating), then there's no capital gain (companies are also switching to this model in order to make their accounting simpler). The 10% discount is treated as ordinary income paid to the employee and is taxed at that rate. So again, with employee stock purchase plans, there's no particular incentive to hold onto the shares for any amount of time. If you sell them immediately after purchasing them, you can make an easy risk-free 7.5% return on your money (assuming a 10% discount and a 25% marginal tax rate).

So after all that, what should you invest all the remaining money in? That's a large topic which I will save for another post sometime in the future, but the answer is simple: just listen to Warren Buffet (the world's richest person) and buy an S&P 500 index fund. I deviate slightly from his advice since I feel that the S&P 500 weights your portfolio too heavily towards big U.S. multinationals and exposes you too much to downturns in the U.S. economy, so my investment strategy is basically to go with no-load S&P index funds plus some as-cheap-as-possible international index funds. I'll talk more about the reasoning and mathematics behind it in a future post.

Computer Graveyard

A local recycling center is having a special tomorrow, with free recycling of old computers. I have a few old ones lying around, so tonight I decided to drag them all out and get them all ready to go.

I was surprised at how much old computer junk I have accumulated over the past few years. It's really sort of embarrassing to consider how many physical resources were used up to manufacture these things, and now I am getting rid of them. Fortunately they will be recycled as much as possible and the nasty pollutants won't go into a landfill.

It's probably a bit late for this, but if you see anything you would want before tomorrow afternoon, let me know (Seattle-area people only).

The pile includes:

- 3 old desktop PCs

- An old 200(?) MHz Pentium I computer which my brother found when some local business went bankrupt (If I remember correctly).

- A 500 MHz Pentium III desktop - the first computer I was able to buy and build for myself in high school, after saving for years.

- A 1.8 GHz Pentium IV desktop - the computer I built while in college.

- 3 laptops

- A 500 MHz PIII Dell Inspiron - my first laptop (now dead)

- A G4 12" Apple PowerBook, with bad hard-disk controller (dead)

- Another Dell laptop, this time a P4, with a bad motherboard (dead)

- G4 Mac Mini (dead integrated power supply)

- One extra original XBox (functional - I randomly won it in a contest, keeping the other one)

- One dead Nintendo Wii (killed by my homemade component cable)

- 3 CRT monitors

- 15" Gateway (bad condition, but functional)

- 17" Sony Trinitron (good condition)

- 21" Sony Trinitron (functional, except for a big gash across the glass screen - I filed a BBB complaint against UPS and then got it for free)

- 2 identical Samsung DVD players (the first one got lost by FedEx for 4 months, during which time I had complained and gotten another one for free)

- Bunch of keyboards

Now that I have started preparing to get rid of all the computers, it's taking a surprisingly long time to shred all the hard-disks with a Knoppix CD. I should have started this earlier..

Grossly under-billed

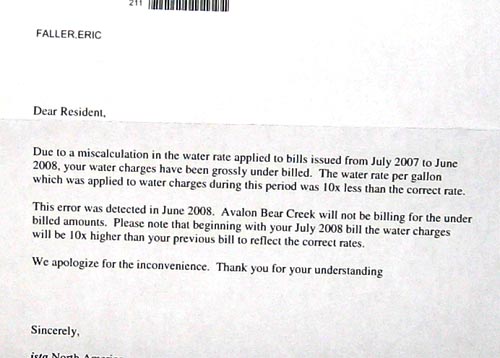

For a while now I've been wondering why I only have to pay $1-2 per month for water. I thought it might have had something to do with all the rain that Seattle gets (lots of extra water, or something).

A letter came today which cleared it up:

I'm wondering how something like this even happens. How can you not notice that your revenue is ten times less than normal for an entire year? Granted, the error probably only happened in one apartment complex out of many, but still..

Financial Profiling & Optimization

Sometimes I wonder if I am spending too much money and should be saving more. It's tempting to try to micro-manage things by clipping coupons or skipping out on meals out with friends, but this strikes me as being similar to premature optimization of code, which as Knuth would say is the "root of all evil."

Just as it's not worth optimizing the 90% of the code where your program spends less than 1% of its time, it might not be worth packing your lunch every day to save a dollar a day ($250 per year) if your real problem is that you unnecessarily spend thousands of dollars on new laptops or other expensive equipment each year.

So what's the first step before I can figure out what to optimize? Profiling, naturally. About a year ago I grabbed a copy of MS Money, which is a personal finance tracking program. It can go online and download your bank account information and credit card statements. It tracks each transaction you make and uses heuristics to assign them to various expense categories. For example if Safeway is the merchant, it'll assign it to Groceries, if it's Comcast, then Utilities, and so on. Sometimes it doesn't know what a specific merchant should be assigned to so you have to configure it.

Once that's all set up, it can generate all kinds of plots showing your cash flow over time, estimated monthly budgets based on trended spending, and various other reports. Here's a pie chart of my spending over the last year:

Without this tool I would probably have had a hard time even estimating the percentage of my spending which goes into various categories, so it was quite interesting to see it charted like this.

The biggest item that jumps out of the chart is obviously "Mortgage/Rent", which in my case is just Rent. It accounts for nearly half of my spending, if you include Utilities (electricity, water, internet) along with it. I'm not sure whether this is a good or bad observation: on one hand I am spending a ridiculous amount of money on rent each month, but on the other hand it's nice to know that I'm not spending a similarly ridiculous amount of money on anything else.

"Education" is the next biggest category, which includes grad school tuition, fees, textbooks, etc.. I'm OK with spending a good chunk of money on this category since self-improvement and continual learning is a good thing. It's also nice that these expenses are completely reimbursed by Microsoft, so the chart of my "real" expenses should probably not even include this category (in which case Mortgage/Rent would fill more than half the pie).

Next biggest is "Hobbies/Leisure", which contains a large range of transactions, the largest of which are from "AMAZON.COM", "GAMESTOP/EBGAMES", "APPLE ONLINE" and "REI STORES." Overall I'm not too concerned about the current size of this pie slice since Hobbies/Leisure is basically the category for "what you do with your spare time," which, in the end, is the whole point of working and making money. I was a bit surprised at the total cost of my Amazon purchases over the last year - I could probably be a lot better about borrowing "read once" books from the library rather than buying them outright (Amazon Prime makes it too easy..).

"Automotive" is up next, which seems to be about equally split between car insurance and gas. I think I already have my car insurance pretty well optimized, so about the only way to reduce spending here is to drive less.

I'm lumping Utilities in with Mortgage/Rent, so "Groceries" is next. The final number in this category was another minor surprise and is probably a good area for optimization. Whole Foods organic milk and cereal apparently add up pretty quickly.

The rest of the spending categories don't sum up to much, so some of them are actually surprising for being so small. I'm disappointed that "Travel/Vacation" is almost not even visible on the chart. I hope that next year's chart will show Travel/Vacation making some big gains. "Gifts" is one category which is too small to show up, which would be totally pathetic of me if it weren't for the fact that most of my gift purchases were probably from Amazon and thus got stuffed into the Hobbies/Leisure slice.

One thing which is notably missing from this chart is money allocated to savings accounts & stock investments (I guess they aren't "Spending" since I still have the money). I had to generate a separate report for savings & stock investments and was pleased to find that the total number there was about equal to the total number in the Spending chart, which means that I have a savings rate of 50%, which is a lot better than the U.S. average, which is hovering around 0% even with the recent "stimulus" package.

Overall this was an interesting exercise to do. Now that I know the actual numbers I don't feel all that guilty about spending too much (except for in a couple of areas). In fact, I'm now feeling like I can probably afford to spend more, especially in "Travel/Vacation".

Bathroom Norman Door

At work one of the bathroom stalls' latch broke, so they put on a new latch. They naturally put it on backwards, so now the door opens outward instead of inward:

There's no way to pull the door open, so you have to reach up and grab the top of the door. It's quite the Norman Door now, because the handle's still on the inside, where you have to push to get it open:

Worst of all, it's the handicap stall:

For some reason people were giving me funny looks when I was taking these pictures inside the bathroom.

Million-dollar thought experiment

I was talking with some friends recently and the topic of housing came up. Even with the recent declines, housing in the Seattle area is still ridiculously expensive. According to the bubble blogs, prices are back down to where they were in May 2006, but things were overpriced back then too, so it doesn't help as much as it might.

During the conversation the idea of group-purchasing and sharing costs came up. It piqued my interest, so I decided to run the numbers and do a thought experiment.

Imagine a group of three friends who want to buy a house together. Let's say they are looking for something in the range of $1 million. How well would it work?

If each person can put down $100,000 as a down payment, the total mortgage on the house would be $700,000, or $233,333 per person. As far as I can tell from reading Wikipedia's "co-tenancy" page, it looks like each person would have a separate mortgage on their portion of the house. So each person would get a $233K mortgage, which at current 30-year fixed rates, would come out to about $1350 per month.

This $1350 number surprised me. It's a bit more than I currently pay in rent, but it's nearly the same. Since it's fixed, it wouldn't go up either, unlike apartment rent. I am sure that in a couple of years my rent will easily be more than $1350 and continue to increase.

Of course, there are additional costs associated with owning instead of renting, such as property taxes. But by my quick calculations, it looks like those would be roughly compensated for by the income tax deductions for mortgage interest (yay for the "ownership society").

So if I could pay what I'm already paying and use it to build up equity rather than throwing it down the drain, it certainly seems like a good idea.

What kind of house could you get for a million dollars? This is where it gets interesting. I did a search for houses nearby where I live with at least 3 beds/baths in the approximate range of $1 million. Here are a couple representative houses:

House #1: http://www.redfin.com/WA/Redmond/13524-157th-Ct-NE-98052/home/450085

$1,075,000

This is a pretty decent house, with 4,000 square feet, 3-car garage, 4 bedrooms, 3.5 bathrooms, and a half-acre of woodlands.

House #2: http://www.redfin.com/WA/Redmond/17304-NE-144-St-98052/home/450854

$989,000

This house is a bit older and smaller, but a bit less expensive as well. It also has the requisite 4 bedrooms, 3 baths, 3-car garage, as well as a rather large back yard for the horses to run around in.

Both houses are vastly better than my current apartment, but I could still live in one of them and pay about what I'm paying now. Something seems impossible here - what's the catch?

As best I have been able to figure out, the catch is probably the fact that you would have to live with two roommates, and it would be significantly more complicated than a regular apartment since you would all own the same house. As soon as one person wants to move out, get married, or make improvements it becomes a huge hassle for everyone. In the worst case scenario the house might suddenly need to be sold out from under you because your roommate went bankrupt or got deported.

Still, having to have 2 roommates does not seem that bad, compared to the greatly increased quality of living and the financial benefits of ownership. Am I missing something obvious?

Another Killer App

While writing the previous post, I thought that Remote Desktop would be the killer iPhone app, but now I've changed my mind. The new killer app is SSHD. Why would an SSH server on a phone be a killer app? Who cares about remotely logging in to their phone's command line?

The answer is that SSHD can apparently run a full SOCKS proxy server with the -D command. Using that, it's possible to use the phone's cellular internet connection on your computer. The setup looks like this:

Yesterday my Comcast connection went down (stupid Comcast), so I had to try it out in order to get back online and get my Dancing Matt fix. It worked surprisingly well - it wasn't really obvious that I was using a phone connection, except that the speeds were pretty slow.

I ran a speed test on the bandwidth, and these were the results:

208 kbps is not that bad by modern standards, and it definitely works if your main ISP connection goes down, or if you're stuck at a wedding with no WiFi.

If coverage is good, a 3G iPhone would probably be significantly better. If you need to save cash it might even be fast enough to use as your main home ISP. Hmm..

Expired Warranty

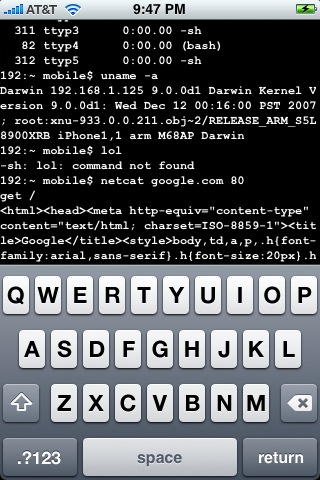

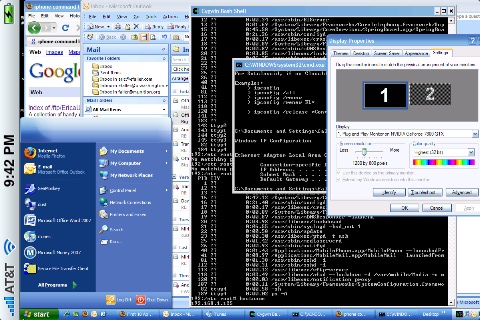

So this week all of the iPhone 2G warranties expired, at least for the people who bought them during the first week. To commemorate the occasion I decided to jailbreak my phone in order to see what all the fuss is about.

Previously, I had decided not to jailbreak since I was afraid that Apple would refuse to replace my phone if the touchscreen or other features broke (as happened to about 50% of the people I know with iPhones). Now that the warranty has expired, that's not much of a concern any more. I also figured that if my phone got screwed up, I could always upgrade to a 3G model next week anyway.

Now that I have jailbroken it, I must say that I can't believe I didn't do this a long time ago. It doesn't seem to mess up the phone at all, at least if you aren't running any custom apps. But the custom apps are completely awesome. These are what a phone with these hardware capabilities was meant to run. It's too bad that Apple's official SDK is so limited and constrained - most of the cool apps will never be allowed by Apple.

I've just gotten started trying out all the apps, but I've already found several cool ones:

Rockin' the Terminal. I booted up vi but quickly realized that that was a stupid idea when you don't have a real keyboard or Ctrl and Esc keys.

Remote Desktop is probably the killer app so far. Now I can log into my home computer and use it no matter where I am in the world (with cellular or WiFi access, of course). You'd think it would be impossible to use on the small phone screen, but with multitouch zooming and panning it actually isn't too bad.

I haven't even gotten to the 'Games' section yet, but I have definitely heard good things about the NES emulator. This should be sweet..

Stocking Up

Less than one week left!

Now I'm starting to wonder: will three extra copies be enough?

2 Years

So as a follow up to the 1 Year stats post, here are a bunch of stats to celebrate 2 years of efaller.com. These are the stats from the last year of web visitors to the site (which does not include RSS readers).

Daily Pageviews

There were an average of 225 pageviews per day, a 12.5% growth YOY but still not enough to make money with AdSense :(.

Browser/OS Combinations

This year IE/Windows increased its share from 54% to 57%, Firefox/Windows increased from 30% to 31%, and Firefox/Mac increased from 4.1% to 4.8%. The biggest loser was Safari/Mac which fell from 7.3% to 3.4%. Linux (all browsers) stayed pretty constant at 0.87%.

Search Engine Keyword Hits

In this year's search engine results I was finally able to overcome the end of false religion is near with searches for my name. The results also reveal growing interest in the zeitgeist with iPhones, GTI iPods, and broken Rock Band drum pedals.

Bugs, cereal bugs and bugs in cereal also made a big showing, and if combined would beat out searches for me.

Another interesting hit is 8bf3a13b - people are still searching for this, and I'm surprised that the answer hasn't been widely posted on the web yet.

Referrers

In the referring sites competition Google dominated all comers, but Simon made a strong second place showing:

1.21 Gigawatts

Cool thing of the day: somebody in my building has a De Lorean and actually drives it to work every day: