Million-dollar thought experiment

I was talking with some friends recently and the topic of housing came up. Even with the recent declines, housing in the Seattle area is still ridiculously expensive. According to the bubble blogs, prices are back down to where they were in May 2006, but things were overpriced back then too, so it doesn't help as much as it might.

During the conversation the idea of group-purchasing and sharing costs came up. It piqued my interest, so I decided to run the numbers and do a thought experiment.

Imagine a group of three friends who want to buy a house together. Let's say they are looking for something in the range of $1 million. How well would it work?

If each person can put down $100,000 as a down payment, the total mortgage on the house would be $700,000, or $233,333 per person. As far as I can tell from reading Wikipedia's "co-tenancy" page, it looks like each person would have a separate mortgage on their portion of the house. So each person would get a $233K mortgage, which at current 30-year fixed rates, would come out to about $1350 per month.

This $1350 number surprised me. It's a bit more than I currently pay in rent, but it's nearly the same. Since it's fixed, it wouldn't go up either, unlike apartment rent. I am sure that in a couple of years my rent will easily be more than $1350 and continue to increase.

Of course, there are additional costs associated with owning instead of renting, such as property taxes. But by my quick calculations, it looks like those would be roughly compensated for by the income tax deductions for mortgage interest (yay for the "ownership society").

So if I could pay what I'm already paying and use it to build up equity rather than throwing it down the drain, it certainly seems like a good idea.

What kind of house could you get for a million dollars? This is where it gets interesting. I did a search for houses nearby where I live with at least 3 beds/baths in the approximate range of $1 million. Here are a couple representative houses:

House #1: http://www.redfin.com/WA/Redmond/13524-157th-Ct-NE-98052/home/450085

$1,075,000

This is a pretty decent house, with 4,000 square feet, 3-car garage, 4 bedrooms, 3.5 bathrooms, and a half-acre of woodlands.

House #2: http://www.redfin.com/WA/Redmond/17304-NE-144-St-98052/home/450854

$989,000

This house is a bit older and smaller, but a bit less expensive as well. It also has the requisite 4 bedrooms, 3 baths, 3-car garage, as well as a rather large back yard for the horses to run around in.

Both houses are vastly better than my current apartment, but I could still live in one of them and pay about what I'm paying now. Something seems impossible here - what's the catch?

As best I have been able to figure out, the catch is probably the fact that you would have to live with two roommates, and it would be significantly more complicated than a regular apartment since you would all own the same house. As soon as one person wants to move out, get married, or make improvements it becomes a huge hassle for everyone. In the worst case scenario the house might suddenly need to be sold out from under you because your roommate went bankrupt or got deported.

Still, having to have 2 roommates does not seem that bad, compared to the greatly increased quality of living and the financial benefits of ownership. Am I missing something obvious?

Rent Increase

After last year's experience of having my rent raised on me by more than $100 per month for two years in a row, I decided to try mitigating the problem by only signing a 9-month lease. I wanted to move my lease renewal period from June to March/February, in order to hopefully lock in low rental rates during the winter. My hypothesis was that June is a bad time to sign a lease due to all of the college kids who just graduated and are starting new jobs at that point, thus creating increased demand for apartments. In my area there's also a large influx of summer-only interns that work for nearby tech companies. The traditional wisdom is that all of these hundreds of interns fill up all the available apartments and cause rents to be higher over the summer. I haven't seen any data that actually backs up this idea, but it seems plausible.

Today I got my lease renewal offer from my apartment manager and I was "pleased" to find out that my rent is only increasing $40 per month for this year, which is much less than in previous years and within the 2%-4% "move out threshold" that I established last year. I want to attribute this "success" to my plan described above, but in all reality it probably has much more to do with the plummeting housing market in Seattle than anything else.

As far as I can tell, there are two schools of thought about the relationship between apartment rents and housing prices:

- The "traditional" model says that rents and prices are tightly linked to each other, and the economy as a whole. If house prices go down, then rents should also go down because there's less money flowing around. Similarly they should both go up at the same time as well. This model seems to have matched the last few years, as both housing prices and apartment rents have climbed to ridiculously high levels.

- The "bubble" model suggests that when a housing bubble "pops", as seems to be happening right now, then rents should actually increase as housing prices decrease since all of the people who would have been buying houses are now forced into renting apartments due to the credit crunch, which increases renting costs everywhere due to increased competition. Similar logic would also seem to imply that rents should decrease or level off during a housing boom, since lots of renters are moving out and buying houses.

The fact that my rent is still going up even though local housing prices are declining seems to indicate that neither theory is totally correct (or as often seems to be the case, reality is just more complicated).

It may also be related to the fact that Microsoft keeps hiring 10,000 new people every year. Any theory is going to predict that local prices are going to be rising in that scenario...

Buy vs. Rent

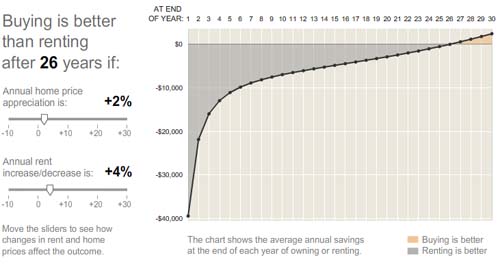

The New York Times has a fascinating Flash-based Buy vs Rent calculator that is much more interactive and detailed than any other calculators I have seen on the web.

If I plug in the numbers I'm currently considering and leave all the interest rates at their defaults, I get the surprising result that buying is better than renting only after 26 years, with a net difference at the end of $72,000:

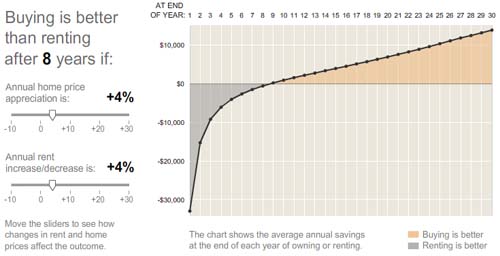

But, switching the "Annual home price appreciation" from 2% to 4%, it's better to buy after only 8 years, and the net difference is $400,000:

In other words, which is better is so completely dependent on what the market does over the 30 years that it's hard to make any good predictions. So despite playing around with the calculator a whole bunch, I'm still at square one in terms of my decision.

One interesting thing I did note is that changing the down payment percentage has almost no effect on the final result, because this calculator accounts for all the opportunity costs (that is, it assumes that you will invest the money you save by renting in the stock market). So in terms of the final net result, there's no reason to make a bigger down payment if you have the money, because you'd be just as well off investing that money in the stock market instead. Similarly, it seems to follow that there's no reason to wait a few years and save up for a bigger down payment, since at that point you would have the same choice (though I have not thought this one through completely). Obviously this doesn't account for other non-strictly financial benefits of having a large down payment, such as the lower risk in case something goes wrong.

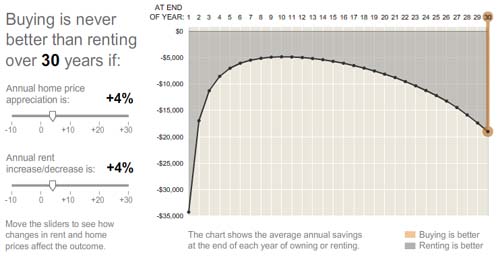

By default the calculator assumes a 5% rate of return on investments, which is a pretty low estimate - that's what I get on my regular savings account, in the long-term the stock market will average much better. If we change it to 10% (not unreasonable), we get this fascinating graph which says that buying is always worse than renting, and after 30 years a renter would have $570,000 more in the bank:

Twiddling with the home appreciation price slider at this point leads to wildly different graphs, so it's obviously impossible to make any good conclusions from it.

If anything, what I'm taking away is that renting is not necessarily that bad of an option compared to buying (despite what the real estate & mortgage industries would tell you), and that renting for one more year will not make a huge difference in the long run - who knows where I will be in a year, it's entirely possible (though improbable) that I could be married and thus be looking for a completely different type of house. Hrm..

Housing Hell

I recently got a note on my door saying that my apartment complex is raising my rent by almost $150 per month when my lease is up in mid-June. This is the second time in as many years - it looks like apartment rents are finally catching up to the recent Seattle housing boom. When I moved in 2 years ago the rent was already high, but now it's verging on the ridiculous. So I think I need to move, but where to?

Thanks to the Invisible Hand, similar apartments are going to cost about the same, so my options for reducing my rent payment are somewhat limited:

- Move into a lower-quality apartment (smaller, no attached garage, more neighbors, bad neighborhood, etc.)

- Move farther away from work (worse traffic/commute)

- Find a roommate

Finding a roommate to split the rent with might be my best option, especially considering that one of my friends is looking for a new roommate in about the same timeframe.

My other main option is to buy a condo (a house is out of the picture unless I want to move 40 miles out of town). Of course the housing market in Seattle has gone ballistic over the last couple of years - some of my friends who purchased 2 or 3 years ago have seen their condos increase in value by almost 50% (!!). Now everything is priced ridiculously high.

Many other parts of the country are seeing housing prices actually fall now, but the Seattle market is bucking the trend and is still going up a bit, or at worst leveling off.

Example: Riverwalk at Redmond is a recent condo conversion (highly visible from 520) at W Lake Sammamish & Leary Way near Redmond Town Center. They've been selling almost as fast as they get on the market. Here's a representative unit:

15825 Leary Way NE #E1 - Redmond - $325,000 for a 758 square foot 1 bedroom/1 bathroom condo, which is a conversion from an apartment (not new construction), and doesn't have a garage. One thing it does have though is a really great location.

As a comparison, the nearby Cleveland condos are new and go for about $390,000 for a similar unit, or $500,000 for a 2 bedroom/2 bathroom condo.

Being from Colorado where housing prices are far, far lower, this just blows my mind that people are eagerly paying this much for tiny little condos. Where I'm from these prices would get you a huge McMansion. But, I guess this is the reality of living on the West coast - it's even worse in California. I'm glad I didn't end up living in Silicon Valley, which is the other main market for software engineers.

l guess the big question at this point is: what's the future hold for the Seattle housing market? Will the bubble pop like in a lot of the rest of the country? Or will it keep going up? Obviously nobody knows for certain, and anybody who knows more than we do is better off keeping it to themselves and making a killing on the side.

My feeling, given the recent Seattle immigration numbers and Microsoft expansion plans, is that recent trends will continue and that the market will continue to rise, though at a slower rate than it has been. At worst, things might level off for a while.

So I'm actually giving serious consideration to buying one of these overpriced things. Of course, $350,000 is a huge amount of money to bet and be wrong :).

Lots to think about..