Jeopardy Typo

In yet another sign of the impending apocalypse, today there is a typo in my Jeopardy calendar.

Discovery

I just discovered that after the gas pedal on my car is depressed all the way, it can still be pushed one "click" further, to accelerate even faster. Sweet.

Buy vs. Rent

The New York Times has a fascinating Flash-based Buy vs Rent calculator that is much more interactive and detailed than any other calculators I have seen on the web.

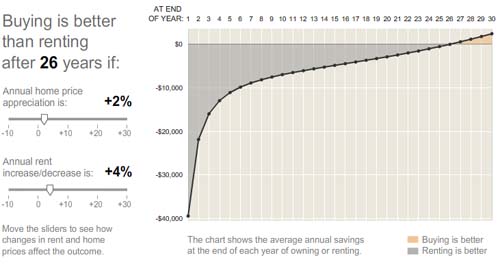

If I plug in the numbers I'm currently considering and leave all the interest rates at their defaults, I get the surprising result that buying is better than renting only after 26 years, with a net difference at the end of $72,000:

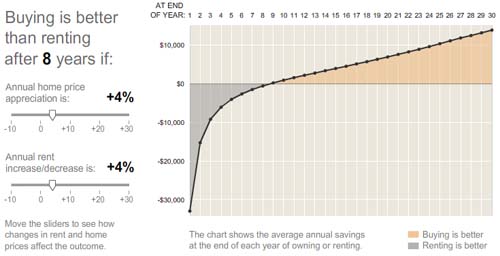

But, switching the "Annual home price appreciation" from 2% to 4%, it's better to buy after only 8 years, and the net difference is $400,000:

In other words, which is better is so completely dependent on what the market does over the 30 years that it's hard to make any good predictions. So despite playing around with the calculator a whole bunch, I'm still at square one in terms of my decision.

One interesting thing I did note is that changing the down payment percentage has almost no effect on the final result, because this calculator accounts for all the opportunity costs (that is, it assumes that you will invest the money you save by renting in the stock market). So in terms of the final net result, there's no reason to make a bigger down payment if you have the money, because you'd be just as well off investing that money in the stock market instead. Similarly, it seems to follow that there's no reason to wait a few years and save up for a bigger down payment, since at that point you would have the same choice (though I have not thought this one through completely). Obviously this doesn't account for other non-strictly financial benefits of having a large down payment, such as the lower risk in case something goes wrong.

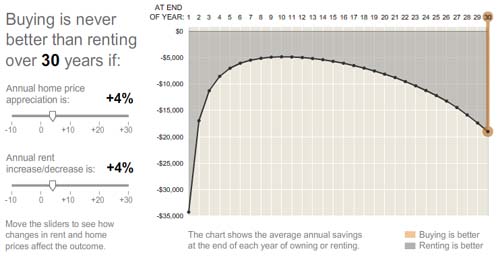

By default the calculator assumes a 5% rate of return on investments, which is a pretty low estimate - that's what I get on my regular savings account, in the long-term the stock market will average much better. If we change it to 10% (not unreasonable), we get this fascinating graph which says that buying is always worse than renting, and after 30 years a renter would have $570,000 more in the bank:

Twiddling with the home appreciation price slider at this point leads to wildly different graphs, so it's obviously impossible to make any good conclusions from it.

If anything, what I'm taking away is that renting is not necessarily that bad of an option compared to buying (despite what the real estate & mortgage industries would tell you), and that renting for one more year will not make a huge difference in the long run - who knows where I will be in a year, it's entirely possible (though improbable) that I could be married and thus be looking for a completely different type of house. Hrm..

Housing Hell

I recently got a note on my door saying that my apartment complex is raising my rent by almost $150 per month when my lease is up in mid-June. This is the second time in as many years - it looks like apartment rents are finally catching up to the recent Seattle housing boom. When I moved in 2 years ago the rent was already high, but now it's verging on the ridiculous. So I think I need to move, but where to?

Thanks to the Invisible Hand, similar apartments are going to cost about the same, so my options for reducing my rent payment are somewhat limited:

- Move into a lower-quality apartment (smaller, no attached garage, more neighbors, bad neighborhood, etc.)

- Move farther away from work (worse traffic/commute)

- Find a roommate

Finding a roommate to split the rent with might be my best option, especially considering that one of my friends is looking for a new roommate in about the same timeframe.

My other main option is to buy a condo (a house is out of the picture unless I want to move 40 miles out of town). Of course the housing market in Seattle has gone ballistic over the last couple of years - some of my friends who purchased 2 or 3 years ago have seen their condos increase in value by almost 50% (!!). Now everything is priced ridiculously high.

Many other parts of the country are seeing housing prices actually fall now, but the Seattle market is bucking the trend and is still going up a bit, or at worst leveling off.

Example: Riverwalk at Redmond is a recent condo conversion (highly visible from 520) at W Lake Sammamish & Leary Way near Redmond Town Center. They've been selling almost as fast as they get on the market. Here's a representative unit:

15825 Leary Way NE #E1 - Redmond - $325,000 for a 758 square foot 1 bedroom/1 bathroom condo, which is a conversion from an apartment (not new construction), and doesn't have a garage. One thing it does have though is a really great location.

As a comparison, the nearby Cleveland condos are new and go for about $390,000 for a similar unit, or $500,000 for a 2 bedroom/2 bathroom condo.

Being from Colorado where housing prices are far, far lower, this just blows my mind that people are eagerly paying this much for tiny little condos. Where I'm from these prices would get you a huge McMansion. But, I guess this is the reality of living on the West coast - it's even worse in California. I'm glad I didn't end up living in Silicon Valley, which is the other main market for software engineers.

l guess the big question at this point is: what's the future hold for the Seattle housing market? Will the bubble pop like in a lot of the rest of the country? Or will it keep going up? Obviously nobody knows for certain, and anybody who knows more than we do is better off keeping it to themselves and making a killing on the side.

My feeling, given the recent Seattle immigration numbers and Microsoft expansion plans, is that recent trends will continue and that the market will continue to rise, though at a slower rate than it has been. At worst, things might level off for a while.

So I'm actually giving serious consideration to buying one of these overpriced things. Of course, $350,000 is a huge amount of money to bet and be wrong :).

Lots to think about..

Locked Out

I recently learned an interesting lesson about the proper protocol for securing locks and shutting garage doors. On arriving home I drove into my garage and walked back out to grab a UPS note on the front door. Not wanting to have to go inside only to come back out the front door, I just reached into the garage to hit the close switch and walked off to get my package.

When I got back with the package, I unlocked the front door with my key and discovered that the "U" latch was locked from the inside (see picture below). I couldn't open the garage door again since my remote was inside the car in the garage, so I spent a good ten minutes trying to reach in the 2-inch gap in the doorway and somehow undo the U latch. Not surprisingly, they are apparently designed to stop you from doing just that, so I was unable to get it open.

I noticed that the latch was held on by two screws, so I got my swiss army knife screwdriver through the door and started to unscrew one of them. It was actually working, although very slowly, and I had one screw about halfway out when some neighbors walked by. Not wanting to look like I was trying to break into an apartment, I took my hand out of the door and pretended to be looking at my UPS package. As I did that I accidentally dropped the screwdriver inside the door and it bounced inside and out of reach.

Now I was really stuck, so I went to get the apartment maintenance guy. A bizarre conversation followed:

Me: "Hi, I locked myself out of my apartment"

Him: "OK, what's the number? I'll get the spare key"

Me: "1072, but the spare key won't help, see I have my key here"

Him: "Then how are you locked out?"

Me: "The U lock is shut from the inside, so I can unlock the door but can't get it open"

Him: "How did you shut the U lock from the outside?"

Me: "Well I went out the garage"

Him: "So why don't you go back in the garage?"

Me: "It's shut, and the opener is in my car, which is inside the garage"

Him: "How did you shut the garage door?"

Me: "I hit the switch and ran out before it closed"

Him: "Mmm... this doesn't make any sense. Let's go look at it"

We walked over to the apartment and I showed him that I was indeed completely locked out, even though I had the key.

Me: "Can you program another remote to open this garage door?"

Him: "Yes, we can do that. But we need the serial number of the opener, and it's inside the garage."

Me: "Don't you have them all written down somewhere?"

Him: "Hmm... no I don't think so"

Me: "What do you normally do in this situation?"

Him: "Nobody has ever done this before"

Me: "Uhh..."

Him: "How about I just kick your door in and then patch it up?"

Me: "OK, but won't that mess up the door frame?"

Him: "Nah, these U lock things aren't really secure anyway"

Me: "Ah well that's nice.."

The trusty U latch and the crack where the door frame was kicked in

Easter Monkey

At work I won a squeezie-monkey in a contest to write an array-shifting algorithm.

It's very cheapo, made in China, and the packaging has pictures of painted eggs and describes it as an "Easter Monkey" in broken English.

I can think of 3 possible explanations for this:

- In other parts of the world they celebrate Easter very differently than we do.

- There was a gross mistranslation of "bunny" somewhere.

- They only have a limited number of squeezie-doll molds, and rebrand them according to the time of year. So you might see the same product as a "Christmas Monkey" or a "4th of July Monkey" depending on when you bought it.